Rent vs. Buy in Southwest Florida: Why Your First Home Is Closer Than You Think

Are you on the fence about buying your first home here in Southwest Florida? Not sure if it’s the right time? While buying your first home sounds really exciting, you might be wondering if right now really makes sense to take one of the biggest financial steps you’ll ever take. It’s normal to feel nervous and wonder:

- Do I have enough savings for a down payment?

- How much will my monthly mortgage be?

- Everyone says that Home Prices and Insurance seem high... can I really be able to afford a home!

The good news is that with the right plan, and the right team in place, homeownership is closer than you think.

Rent vs. Buy? Why It’s Smarter to Buy Than Rent in Southwest Florida

It’s a common question...Should I rent or buy? Renting may feel like the easier, safer option, but what it doesn’t do is help you build long-term wealth. Rents in Florida continue to rise, and every monthly payment goes straight to your landlord and their wealth, not yours.

When you buy a home, your monthly housing cost becomes an investment in your future. Owning a home helps you build wealth over time. As you pay down your mortgage and your property value increases, you will grow equity.. this is wealth that belongs to you. Along the way, you gain tax advantages through deductible mortgage interest plus the ability to tap into equity for major expenses should the need arise. Over time, the more equity you've built will be more money in your pocket when it's time to sell.

The truth is, if you’re able to make the numbers work, buying a home has powerful long-term financial benefits.

Renting vs. Buying: The Long-Term Impact

When you own a home, your payments are an investment in your future. Renting, on the other hand, means your money is gone for good – it helps your landlord build equity, not you. Renting works for those not ready (or able) to buy today. But if you can make the numbers work, buying a home builds equity and sets you up for long-term financial success. So, even though renting may seem easier now, it just can’t match the benefits of homeownership.

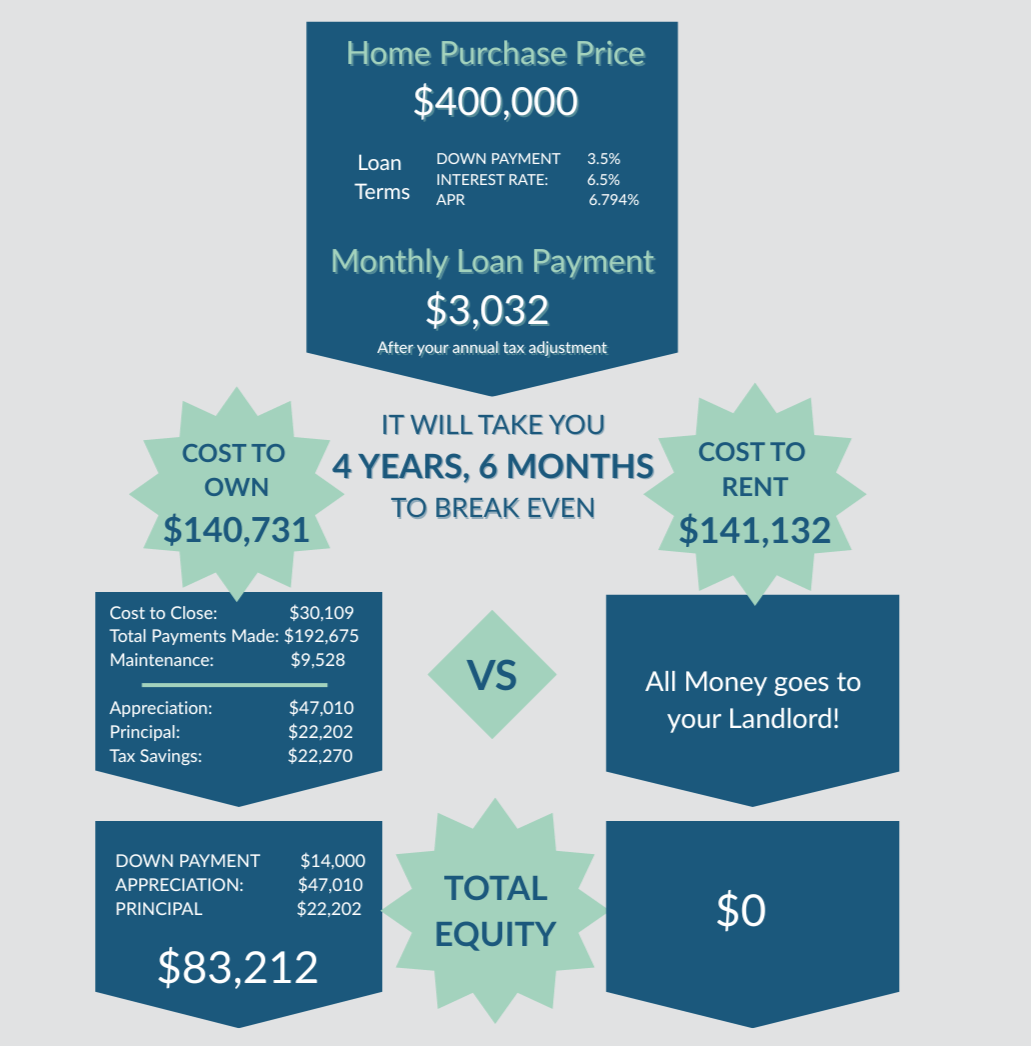

In this example below, with a home purchase at $400,000, it would take less than 5 years to break even with the amount you would spend on rent. The difference? A potential increase of your wealth totalling $83,212 versus $0 if you remained a renter. That's a big deal!

On average, your home increases in value approximately 2.5%-3% per year. So the longer you own the home, the greater your equity will become as your home value increases and your mortgage decreases. This equity could help fund the downpayment for your next home when you sell this one.

Debunking the Myths About Buying Your First Home

Sometimes listening to advice from someone who bought their last home in 1982 isn’t always the best idea- especially since so much has changed over the years. Let’s dive into some myths and the reality of some common pain points that hold first-time homebuyers back from their first home purchase.

“Buying is always more expensive than renting."

MYTH: Renters often assume that a mortgage will cost more than their rent.

REALITY: Many times, mortgage payments (especially with today’s competitive loan options) can be similar to or even less than rent, and unlike rent, payments build equity, which in turn build wealth.

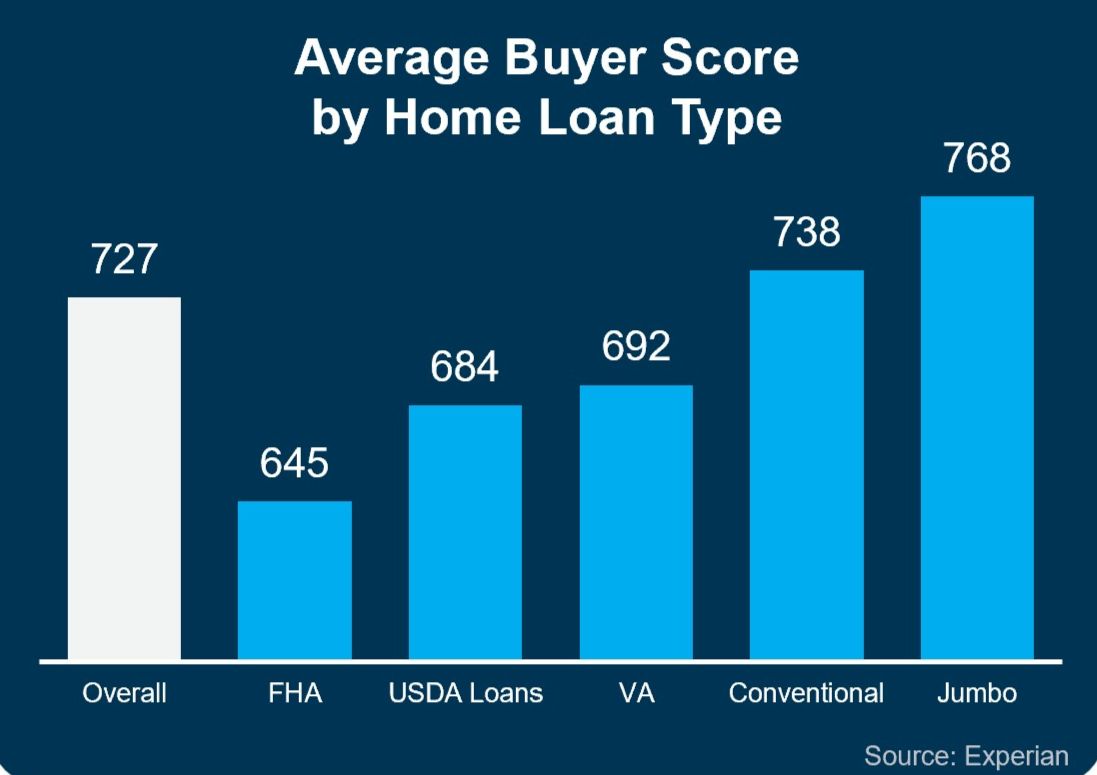

“My credit isn’t perfect, so I can’t qualify.”

MYTH: People think only those with excellent credit (750+) can get a mortgage.

REALITY: Many lenders approve buyers with credit scores as low as 580 (with FHA loans) or 620 (for conventional). There are also ways to boost credit quickly before applying.

“I need a 20% down payment.”

MYTH: Many renters believe they must save tens of thousands of dollars before buying.

REALITY: There are loan programs that allow as little as 3%down, and FHA loans go as low as 3.5%. Veterans can access VA loans with no down payment. While putting more down can lower monthly costs, it’s not a requirement for everyone.

“I should wait until home prices and interest rates drop.”

MYTH: Some renters delay because they’re waiting for home prices to drop or rates to fall significantly.

REALITY: Timing the market rarely works. We are seeing interest rates today at more realistic levels than in recent years with the extremely lows and highs now a distant memory. Even as our home prices adjust down to a more normalized level here in Southwest Florida, the interest rates will continue to fluctuate which could potentially offset any savings. Plus, waiting means missing out on equity you could be building (think personal wealth!)

“It’s just cheaper and easier to rent forever.”

MYTH: Renting feels simpler—no maintenance, no taxes, no responsibility.

REALITY: While a homeowner who leases out their home will have home insurance, property taxes and general maintenance costs, their renters are essentially paying for those indirectly in rent. Over decades, renters spend far more with no return, while homeowners gain equity, tax advantages, and financial security.

Why Getting Pre-Approved Is So Important

There’s one essential step in the homebuying process you may not know a whole lot about, and that’s pre-approval. Here’s a rundown of what it is and why it’s so important to take care of before you start looking at homes.

What Is Pre-Approval?

Pre-approval is like getting the green light from a lender. It gives you a sense of how much you can borrow for your home loan. To determine that number, a lender starts by looking at your financial history. Here are some of the documents they may ask you for:

- W-2s and tax returns

- Pay stubs and bank statements

- Investment account statements

- A history of where you’ve lived

After they go over everything, you’ll get a preapproval letter showing what you can borrow. Since it determines the maximum amount you can borrow, pre-approval also helps you figure out your budget. After you know what works for you financially, partner with your agent to tailor your search to homes that match your budget. That way, you don’t fall in love with a house that’s realistically out of your comfort zone.

Your monthly loan payment will consist of 4 components: Principal, Interest, Taxes, Insurance. (This is also known as “PITI”.)

AGENT TIP: When you are looking for a home with the preapproved loan amount, it will be important to know what your lender is estimating your interest rate, your annual taxes and insurance. With this, your agent can adjust your home search accordingly (specifically avoiding areas where insurance or taxes may be higher)

Once you find a home you want to put an offer on, pre-approval has another big perk. It not only makes your offer stronger, it also shows sellers you’ve already undergone a credit and financial check. When a seller sees you as a serious buyer, they may be more attracted to your offer because it seems more likely to go through. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

Things To Avoid After Applying for a Mortgage

Consistency is the name of the game after applying for a mortgage. Be sure to discuss any changes in income, assets, or credit with your lender, so you don’t jeopardize your application. Don’t change bank accounts. Don’t apply for new credit or close any credit accounts. Don’t deposit cash into your accounts before speaking with your bank or lender. Don’t co-sign other loans for anyone. Don’t make any large purchases (ie.. furniture, appliances, cars, etc)

Money Saving Tips That Can Save You Big When Purchasing Your First Home

The Loan Downpayment

If you're trying to get ready to buy your first home, one of the things you may be thinking about a lot is the down payment. That might be because you’ve heard you need to put down 20% of the home’s price. But that isn’t necessarily the case. Unless specified by your loan type or lender, it’s typically not required to put 20% down. For example, there are loan options that require as little as 3% down, or even 0% for certain qualified borrowers, like Veterans. So, while putting down more money does have its benefits, it’s not essential.

- 1% Down Conventional Loan Programs – Affordable entry into conventional financing with as little as 1% down.

- FHA Loans – Require as little as 3.5% down with flexible credit guidelines.

- VA Loans – 0% down for qualifying veterans, active-duty service members, and surviving spouses.

- USDA Loans – 0% down for homes in eligible rural areas, including parts of Southwest Florida.

- Conventional 97 Loans – Just 3% down for qualifying first-time buyers.

In addition, there’s a growing number of down payment assistance programs designed to help you over the cost of your down payment. And these programs aren’t small-scale help either. To name a just a few of the many available programs:

- Hometown Heroes – Up to 5% in grant funds for first-time homebuyers with eligible occupations working in a Florida brick-and-mortar location.

- FHA Down Payment Assistance Programs – 3.5%–5% towards down payment and closing costs to make homeownership more accessible

To make it even better, in some cases, you may be able to qualify for multiple programs at once, giving your down payment an even bigger boost. Believe it or not, the majority of first time home buyers qualify for some kind of assistance but not many use it! Talk with a lender about your options. They’ll help you figure out where you stand today and how to access the resources you may qualify for. Because help is out there, you just need to work with a pro to take advantage of it.

The Closing Costs

In addition to the down payment for your loan, you’ll need to plan for closing costs, typically 3–3.5% of the purchase price. These include fees for title, lender charges, and prepaid taxes and insurance. There is some good news. There are negotiation strategies your agent can make for seller concessions that can help ease the burden. Common requests are:

- Seller to credit a portion or all of your Closing Costs. This is especially possible if the home has been on the market for a while.

- Request for the seller to cover the cost of the Owner’s Title Policy which is roughly .5% of the home purchase price.

- Credits for HOA fees: Request the seller to credit a portion of HOA fees.

- Request Rate Buy Down credits from the seller which would be used to reduce your interest rate on your loan, saving money on your monthly payment!

Tactics like these can put thousands of dollars back in your pocket.

Smart Home Search Strategies in Southwest Florida

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. You may just need to think a bit differently about what you plan to buy. Your first home is rarely your last so sometimes expanding your search to include fixer-uppers, townhomes, or even different locations could be the key to getting your foot in the door.

- Consider Fixer-Uppers:. A fixer-upper is a home that’s livable but requires some renovations. Because of the repairs involved, these homes are usually less expensive up front than move-in-ready options. With the right renovations, adding the right features could help increase your investment value.

- Look at Townhomes or Villas: Typically more affordable than single-family homes, they’re a great entry point for first-time buyers.

- Understand HOA Fees and what they cover: In Southwest Florida, we have many communities managed by HOA’s. HOA fees can cover a wide range of things from community amenities, lawn maintenance, roof and building maintenance, building insurance, select utilities like water and cable, security, etc. As you evaluate total cost of ownership, understand what the HOA will cover for you as part of your dues versus how much it would cost if you funded it on your own.

- Understand Insurance Requirements: Your lender's insurance requirements are greater for homes located in a flood zone. You would be required to have both a flood and a home insurance policy. Consider locations not in flood zone areas to keep your insurance premiums lower. Homes with newer roofs and storm protection (like impact windows/doors, manual shutters) typically have lower insurance premiums than those that do not.

Partnering with a local real estate agent in Southwest Florida can help you find the right fit and negotiate the best deal.

5 Tips To Overcoming First-Time Homebuyer Nerves

Feeling nervous about repairs or expenses? That’s completely normal but with proper planning, knowledge and the right team in place, you can overcome this with ease. Here are 5 tips to help ease your nerves.

- Get Pre-Approved Early. One of the biggest stressors for first-time buyers is uncertainty around affordability. Pre-approval gives you a clear budget, shows sellers you’re serious, and helps you avoid falling in love with homes outside your price range.

- Understand the "All-In" Costs (Not Just the Mortgage). Fear often comes from the unknown. Sit down with your lender and agent to map out your full “all-in” monthly costs: mortgage (which includes your taxes and insurance) plus any HOA fees, utilities and a budget for incidentals. When you see it broken down — and compare it to what you’re already paying in rent — the decision feels less overwhelming.

- Don’t be intimidated by a home inspection report. Every house (even new construction) will have issues listed in an inspection report. The key is to separate minor cosmetic items from serious deal-breakers. Lean on your agent to help you interpret what really matters. This turns what feels like a red flag into a manageable fix.

- Keep Your "Eyes on the Prize". Buying your first home is emotional and it’s normal to second-guess yourself. Remember: you’re not just buying four walls, you’re investing in stability, equity, and your future wealth. Focusing on your long-term goals of homeownership helps you push past short-term nerves.

- Lean on Your Team of Pros! Trying to do everything alone fuels anxiety. A strong real estate agent, lender, and inspector are there to guide, protect, and negotiate for you. When you know you’ve got experts watching your back, the process feels far less intimidating.

Buying your first home doesn’t have to feel overwhelming—with the right planning, education, and an expert team to guide you through the process, homeownership may be closer than you think. Ready to take that next step? Let’s have a chat about your goals and let’s make it happen together.

Final Thoughts

Some of my favorite clients to work with are First-Time Home Buyers. I love guiding them through their journey and experiencing their energy and excitement but most of all, I love closing day and their HUGE smiles from ear to ear!

To help you start your homebuying journey, I would like to give you a free copy of my newest guide:

"The Ultimate Homebuyer's Playbook- Everything You Need to Buy with Confidence in Southwest Florida."

Click to Download The Ultimate Homebuyers Playbook

Enjoy this this step-by-step guide designed to give you everything you need to navigate the homebuying process here in the Fort Myers, Cape Coral, Estero and Bonita Springs area of Florida. This guide will serve as an excellent tool to give you :

- A clear breakdown of the buying process—from representation to closing and all steps in between.

- Tips to avoid costly mistakes and save time during your search.

- What makes the SW Florida market unique (HOAs, flood zones, insurance, taxes).

- A glimpse into the key cities in Lee County, Florida and the lifestyle that makes this area so special— beaches, boating, golf, sunshine, and more

Happy House Hunting!

Categories

Recent Posts