What the Headlines Aren’t Telling You About Lee County Home Prices

If you’ve been scrolling through national headlines lately, you might think Florida home prices are falling off a cliff — especially condos. Some outlets make it sound like values are collapsing in real time and buyers should brace for a full-blown crash.

But here’s the thing… Lee County, Florida isn’t living the same housing reality as national headlines. And when you compare today’s prices to where they should be based on normal, pre-COVID appreciation, the story becomes much calmer — and honestly, much more logical. Lee County (which includes Fort Myers, Cape Coral, Estero, and Bonita Springs) experienced the same wild ride as the rest of the country during COVID, but the data shows we’re now settling back into a much healthier rhythm.

The “Normal” Baseline: 4% Annual Appreciation

Before COVID, a reasonable benchmark for Lee County home prices averaged about 4% appreciation per year, which is a steady, healthy pace that reflects typical long-run market growth. So let’s ask a simple question: What if home prices had just followed that normal 4% path from January 2020 to today?

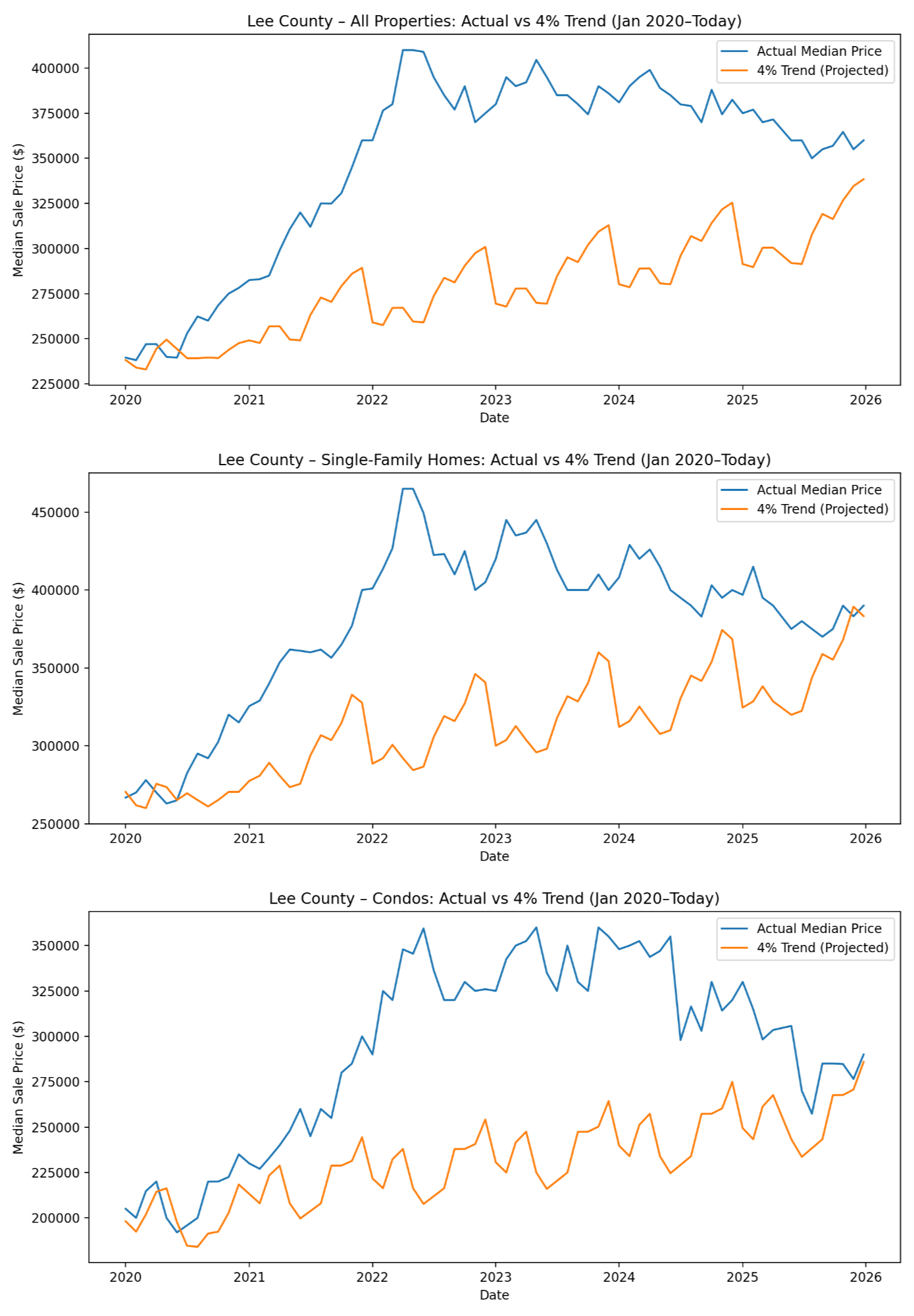

The charts below compare the actual median sale prices from Lee County sales history to an average 4% appreciation trendline.

All Properties: Close to Normal (Not a Crash Story)

In January 2020, the median sale price for all properties sold in Lee County was about $239,500. By the end of 2025, the median price is about $360,000. Using the 4% benchmark projection for today lands around $338,400. What this means is the current market is only about 6% above where it “should” be under normal growth.

✅Translation: We’re not wildly overpriced anymore. We’re pretty close to trend. And from the peak in 2022 (around $410,000), prices have cooled about 12%, which looks a lot like normalization — not collapse.

Single-Family Homes: Basically Right on Target

Single-family homes followed the same pattern, just with slightly different numbers.

- January 2020 median price: $266,750

- End of 2025 median: $390,000

- 4% projected benchmark: $383,246

This means single family home pricing is only 1.8% above the benchmark.

✅Translation: Single-family prices are essentially back to normal trend after the COVID surge. We did see a peak around $465,000 in 2022, and prices have eased about 16% since then. Again, more “cooling off” than “plunging.”

Condos: The “Headline Villain”… but Still Near Normal

Condos are the category everyone is panicking about — and yes, they’ve cooled more than single-family homes. But even here, reality isn’t matching the media drama.

- January 2020 median: $205,000

- End of 2025 median: $290,000

- 4% projected benchmark: $285,913

This means condo pricing is only ~1.4% above “normal trend.”

✅Translation: Even condos are close to where they should be if we had simply followed steady pre-COVID appreciation. Yes, condos hit a sharper peak later — about $360,000 in May 2023 — and have come down around 19% since then. But that’s what happens when a market gets artificially inflated and then returns to earth.

So… What Actually Happened and Where Are We Now?

Let’s call it what it was: COVID created a once-in-a-generation pricing distortion. People relocated to Florida in record numbers. Demand spiked. Inventory was thin. Then the real accelerant hit: 2.75% mortgage rates! At that point, affordability math broke. Buyers could pay much more without raising their monthly payment — and prices surged faster than any “normal” appreciation model could keep up with. That spike wasn’t normal appreciation. It was an economic event.

Over the last few years, Lee County has been doing something surprisingly healthy which is returning to the long-term appreciation trend line. Prices didn’t “collapse.” They deflated back toward normal. And if you compare today’s numbers to what steady 4% appreciation would have produced since 2020, Lee County is not far off at all — especially in single-family and condos.

Bottom Line

National headlines can be entertaining… but they’re often built for clicks, not clarity. In Lee County, the data says this:

We had an abnormal spike. We’re normalizing. And prices are now remarkably close to where they’d be under steady pre-COVID appreciation.

Not plunging.

Not collapsing.

Just… returning to reality.

Categories

Recent Posts